10 000 +

active users of the platform

10 +

local and international insurance companies

3 mln +

processed claimes for the last 15 years

150 +

daily claims processed through mobile apps

BULSTRAD VIENNA INSURANCE GROUP is one of our first partners pioneer automated claims handling processes. The upgrades and changes requests are ongoing until today in a constant effort to outperform on efficiency, speed and reliability. Now, BULSTRAD is at the end of a year full of achievements and many challenges, which exceeded its own expectations. How to keep the pace of work and even speed it up many times, tells Lyubomir Andreev, Director of Digitalization and Innovation Department.

What was the biggest challenge of 2020?

Undoubtedly, the biggest challenge was overcoming the stress and creating a streamlined organization in the transition to fully remote work, in an extremely short time. I realized that I could count on the people around me and that adaptability was the quality we needed to develop most actively. Combined with a quick response, it will help us come out of the crisis and look ahead.

With what will you remember the past year?

There is no going back to the old model of work. It is important for every business to figure out how to adapt to change, because otherwise it risks losing much of its market share. The pandemic has become a catalyst for the inevitable processes of digitalization.

Did BULSTRAD invest in digitalization during the pandemic?

The existence of a corporate strategy for digital transformation of BULSTRAD helped us a lot during the pandemic. In fact, the main impact of the pandemic was to speed up the implementation of the strategy and to secure funding of new digital initiatives more quickly. Remote work has created some difficulties. We introduced many changes and the top management is positive that most of these changes will be preserved after the pandemic. In principle, among the main challenges that an insurance company in Bulgaria faces, are the paper related processes and their traceability. In addition to complications and waste of time, paperwork often makes it difficult for employees to search for important information and is a prerequisite for loss.

Have you tried new technologies and what new solutions have you introduced?

We have implemented solutions that help the easier and faster remote service of the company's customers. As part of the project for automation of insurance claims handling activity, as well as for ensuring the safety of our clients, we implemented a process for submitting an online notification for occurrence of a Casco insurance event through the Company's website. With the help of Revauxy we managed to start the project in literally 2 weeks. At the beginning of the year, we started a project for new policy issuance entirely online. Initially, we introduced Bonus Home – Property insurance and Travel Package – Travel assistance abroad, and now to them are added Motor Third Party Liability and Casco. With the introduction of the state of emergency in March, Bulstrad introduced online payment of installments for all products. We are currently working on a project for fully remote customer service of Bulstrad clients.

Do you use mobile applications?

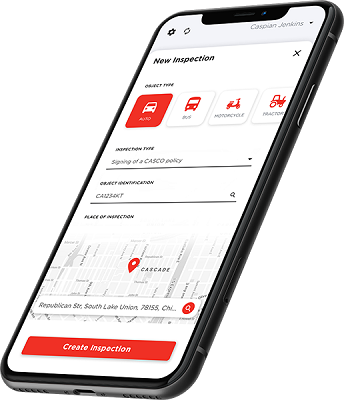

In the age of digitalization, mobile devices are an indispensable work tool. With the new Bulstrad Explorer application, we have fully digitalized the inspection for a new Casco policy issuance. The application performs two-way data exchange with the SmartClaiMS claims management system. Each employee or authorized partner of BULSTRAD can conduct an inspection and can take photos in a certain order, since the application is extremely intuitive to use. The data is collected and processed through unified platform. The mobile application also works offline, and in the presence of Wi-Fi connection or if you want to use mobile internet, it synchronizes and saves the data from the inspection directly in the database. With automated anti-fraud controls, liquidation experts can easily compare inspection results and protect the company from fraud. Security is guaranteed and is in accordance with the corporate policies of the organization.

Were there any challenges during the start and the implementation of the project?

There are always challenges, but even at the stage of business analysis and the design and functionality of the application styling, we received full support and a lot of useful advice from the experts at Revauxy. We have been working together for more than 15 years. It is true that long-term partnerships provide high added value for business. Even more so by using innovative technologies and following the latest trends in insurance. Just like every new thing, the implementation took some time, especially with the company's partners, but by now everyone is actively using it and they appreciate the ease and convenience of work.

Apart from convenience and a better customer experience, does the use of the Bulstrad Explorer mobile application have a purely economic effect?

Oh, of course, we have optimized a lot of resources in the company. Starting with the fact that we do not print out the report with the inspection results, also the processing time is seriously shortened and the risk of information loss and fraud is reduced. Now everyone in the company that is authorized has easy and convenient access to the data from any inspection.

What is the key to being successful in a time of crisis?

Innovation, focus on Bulstrad customers and partners, and processes automation. Of course, you must also have reliable partners, confident and determined like Revauxy.

What prospects are open or are you about to open this year?

We continue to develop the strategy for digital transformation of BULSTRAD with a focus on the client and providing an even better customer experience. We are adding new online services. With Revauxy we will work on the digitalization of even more processes in the liquidation area. In the near future, we will offer a new mobile application for the company's customers.